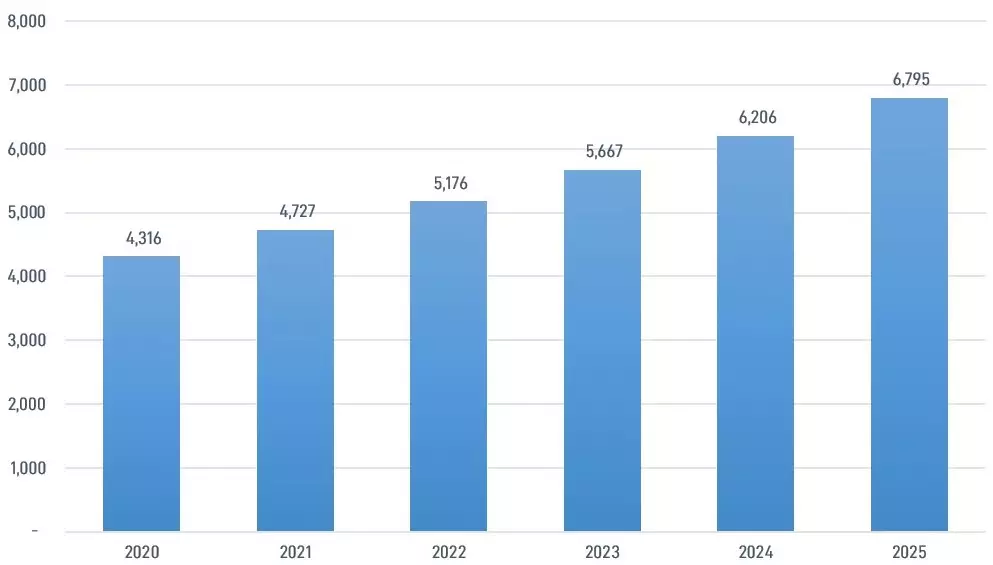

The estimated annual global MLCC production volume stands at slightly below 4.5 Trillion pieces today. There are only 2 passive components with production volumes at multiple Trillions; MLCCs and Chip resistors. According to Business Wire (a Berkshire Hathaway Company) the MLCC market is expected to grow at a CAGR of 9.5% between now and 2025.

Global Annual MLCC Production Volumes

Some of the sectors that are and will be driving the demand for MLCCs are:

• Electric Vehicles – autos, trucks

• Internet of Things (IoT)

• 5G (Mobil comm. Devices)

• Industry 4.0

• Wearable devices (new)

• Telemedicine (new) and pervasive health (new)

• Internal combustion and Hybrid vehicles

• Drones – small package delivery & people transport (after 2023)

Assuming that the current reported close-to-100% capacity usage of fabrication equipment is correct, this growth rate represents the following annual deficit of MLCC pieces per:

| 2021 | 2022 | 2023 | 2024 | 2025 |

| 411,000,000,000 | 449,000,000,000 | 491,000,000,000 | 539,000,000,000 | 589,000,000,000 |

These numbers represent great opportunities for PTC and other makers of equipment and raw materials used in the production of MLCCs. As an example, the current state-of-the-art stacking systems are able to make, on AVERAGE, 1,600,000,000 pieces of MLCCs per year (a mix of various sizes). To make 411B pieces, globally, 256 stacking machines will be needed in 2021 alone. The scenario is closely the same for makers of metallization (termination) systems and tooling, tape casting machines, reel taping, or other systems.

The challenge for equipment suppliers is not in keeping up with the demand for systems with existing capabilities, but it will be in 2 areas:

1) Machines that are capable of processing ultra-small (008004 as an example) sizes and parts with ever increasing capacitance to volume (C : V) ratios.

2) Incorporation of capabilities for Industry 4.0 and AI (Artificial Intelligence) in new generation machines. This is an uncharted territory for most companies

Suppliers that can meet these challenging demands will be the ones thriving in the new decade which started this year. PTC is actively working on offering solutions that have and will result from the above opportunities.

NEW CREATIVE PROCESSES AS A RESULT OF THE PANDEMIC

By definition, FATs are done at the supplier’s factory in the presence of the customer prior to shipment of a system to enable customers to use their new systems right after installation and calibration. Due to travel restrictions related to Covid-19, our customers could not travel to our factory and therefore a new way of conducting the FAT was needed. As a result, our customers and our engineering and quality teams agreed to perform FAT remotely.

To perform the tests required by our customer, we had to set up stationary cameras and use cameras in mobile phones to show how the system was performing in real time in accordance to customer defined requirements. Additionally, we videotaped several sessions and sent parts processed during the videotaped test sessions to our customer for evaluation and approval.

We are currently working on developing processes to allow remote installation of systems as units become ready for shipment while travel restrictions are still in place.

Nothing takes place of being present at a customer facility and close in-person cooperation with customer’s various teams during an installation or a FAT test. When this is not possible, we at PTC will be ready to support our customers remotely.